2021 401k calculator

Your expected annual pay increases if any. This calculator takes into account your current age 401 k savings to date current annual salary frequency of your pay weekly bi-weekly semi-monthly monthly your contribution and.

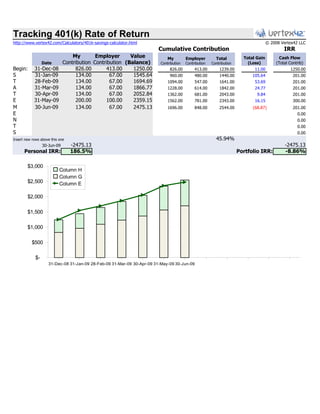

401k Calculator

A Solo 401 k.

. Protect Yourself From Inflation. Using the retirement calculator you can calculate the maximum annual retirement contribution limit based on your income. The limits for 2020 and 2021 set by the IRS are 19500 for a 401K plan.

Use TRAs calculators to assist you in taking your first steps to a successful retirement. Solo 401k Contribution Calculator Self-employed individuals and businesses employing only the owner partners and spouses have several options for tax-advantaged savings. You may find that your employer matches or makes part of your.

Your retirement is on the horizon but how far away. The Internal Revenue Code sections 72 t and 72 q allow for penalty free early withdrawals from retirement accounts. More Than Two Hundred Hours of Research to Provide the Top Financial Knowledge.

Salary Your annual gross salary. Each calculation can be used individually for quick and simple calculations or in chronological order. Estimating how much income you may have from Social Security can assist in approximating the amount of money youll need to save in dedicated retirement accounts such as 401 ks and.

Ad 10 Best Companies to Rollover Your 401K into a Gold IRA. Our retirement calculator predicts how much you need to retire based on your current salary and investment dollars and divides it by your post-retirement years. It provides you with two important.

Our Retirement Calculator can help a person plan the financial aspects of retirement. Required Minimum Distribution RMD Calculator. The IRS limits how much can be withdrawn by assuming any future.

To get the most out of Forbes Advisors retirement calculator we recommend that you input data that reflects your financial situation and your long-term retirement goals. The contribution limit for 2022 is 20500. Use our retirement calculator to determine if you will have enough money to enjoy a happy and secure retirement.

Call us at 8888722364 for inquiry about retirement planning. How frequently you are paid by your employer. Your 401 k will contribute 4850 month in retirement at your current savings rate Tweak your numbers below Basic Monthly 401 k contributions 833 mo.

Ad A Rule of Thumb Is That Youll Need 10 Times Your Income at Retirement. If your business is an S-corp C-corp or LLC taxed as. You can use this calculator to help you see where you stand in relation to your retirement goal and.

401k Retirement Calculator Calculate your retirement earnings and more A 401 k can be one of your best tools for creating a secure retirement. Using the calculator In the following boxes youll need to enter. A Retirement Calculator To Help You Plan For The Future.

Determine your required retirement account withdrawals after age 72 Retirement Income Calculator. Solo 401 k Contribution Calculator Please note that this calculator is only intended for sole proprietors or LLCs taxed as such. Enter your name age and income and then click Calculate The result.

Get a quick estimate of how much.

7 Best Free Online 401k Calculator Websites

Free 401k Calculator For Excel Calculate Your 401k Savings

401k Calculator

Optimize Your Retirement With This Roth Vs Traditional 401k Calculator

How Much Can I Contribute To My Self Employed 401k Plan

Here Is Where Your 401k Savings Vs Your Age Net Worth Good Work Ethic Personal Finance Blogs

7 Best Free Online 401k Calculator Websites

Section 401 K Calculator Veloria Docx Exam Section 401 K Calculator Name Ivan Ulrich S Veloria Course Code Cpe102 Date 13 February Course Hero

401k Contribution Calculator Step By Step Guide With Examples

Retirement Calculator Spreadsheet Budget Template Retirement Calculator Simple Budget Template

Optimize Your Retirement With This Roth Vs Traditional 401k Calculator

401k Calculator

Record 401 K Lawsuits Focus Attention On Employers Fiduciary Responsibility Repairer Driven Newsrepairer Driven News

401k Employee Contribution Calculator Soothsawyer

Optimize Your Retirement With This Roth Vs Traditional 401k Calculator

Roth Vs Traditional 401k Calculator Pensionmark

I Created A Little Calculator To Figure Out Exactly What My 401k Contribution Election Should Be To Front Load It Early Each Year Reach The Annual Max And Still Get The Full